Welcome to the world of health insurance sales where you will explore a wide range of context-related “health insurance scripts”. Why wait? Look closely at this blog and gain insights for closing deals and connecting with potential customers. Boost success in the health insurance industry with us!

Why should you go for Health Insurance Cold Calling?

You can consider cold calling for health insurance to expand your customer base as it permits you to reach out to potential customers who may not be aware of your product/ service offerings; with cold calling, you have access to one-on-one conversations with your customers, it’s kind of offering a personalized approach.

Are you facing problems while building strong relationships with potential customers?

Don’t miss the chance to maximize the power of cold calling! Establish a rapport and build strong relationships by demonstrating your expertise and knowledge in particular products/services i.e. health insurance plans.

Tasks like dialing numbers, looking up contact information, and analyzing call outcomes can be automated with a sales dialer.

By actively listening to calls, you can efficiently handle the concerns that your customers may have.

Cold calling might be a challenging task, but it is highly fruitful! According to studies conducted,

“82% of buyers accept meetings/deals with sales reps who reached them through making outbound calls”.

Outbound calls are a powerful technique as it allows you to generate leads and convert them into sales. So, you can significantly increase your sales and overall business growth with cold calling optimization.

Just remember: Have patience and perseverance when making outbound calls.

How to write a script for health insurance?

Confused about what to include in your sales script?

Don’t worry! Step through these pointers below, understand them and implement them in your sales script. Following these pointers will enhance your sales scripts more efficiently and will increase your sales conversion rates.

1. Try to be a look-alike custom consultation

Custom consultation for health insurance involves your audience’s understanding and clear and concise communication, and one of the most important factors is a “client-centric” approach.

By utilizing automated dialing software, insurance agents can increase their call volumes, engage with more leads, and manage their communication efforts effectively.

Try to make sure that while writing a script, you align it with your specific audience, organizational goals, and the unique offerings of your product or services.

2. Ask open-ended questions

Always prefer asking them open-ended questions to let them express their concerns or queries they may have. For instance, you may ask them, “Currently, are you facing any concerns or issues regarding your health insurance coverage?”

This tip encourages individuals to offer detailed information and insights that further enhance their understanding of their concerns, needs, and preferences. Thus, incorporate these and ensure meaningful and engaging conversation.

3. Actively listen to their answers

Do you want to generate rapport and build trust in communication? Then, focus on actively listening skills not just to gain a deeper understanding but to create a meaningful and personalized experience for your client who seems interested and wants to gain knowledge about health insurance guidance.

Allow them to express their opinion and thoughts before you respond fully. Try to make sure that you don’t interrupt them when speaking. It may hinder their willingness to share their information.

4. Avoid complex ideas and go for relatable languages

Go for relatable languages to avoid any kind of confusion between you and your potential clients. Instead, they use simple languages, which makes them easier to interact with.

Just like you can use the word” healthcare provider” instead of “medical practitioner”.

Try to break down complex information into digestible pieces that your client can easily digest without any problems in between. This way, clients can make an informed decision by absorbing information.

5. Address their pain points

Make yourself familiar with their common pain points and try to resolve them immediately for better results. Their common pain points may involve cost-related policy terms, coverage benefits, paying premiums monthly/yearly, etc.

Keep track of their concerns or pain points that may arise during consultations.

Addressing their pain points will demonstrate your industry to be positioned as a trusted advisor among all others. Let your client experience a supportive environment!

6. Make a habit of refining your script

Stay ahead in your specific industry by keeping yourself updated on new developments, trends, patterns, and information. Try to enhance your knowledge and expertise and acknowledge the same in your health insurance script.

Remember, you have to adopt a habit of refining scripts because it’s an ongoing process.

You can refine your insurance script based on feedback or outcomes that were recorded from previous ones and then make necessary changes to your script for better results.

7. Paint a picture of your health insurance that impacts your life

Demonstrate why they should choose your offerings over others. You must ensure that your health insurance scripts reflect the benefits and value of your insurance solutions.

You can instill confidence in potential insurance seekers by creating a positive and vivid picture of your health insurance product/services.

Showcase the success stories of satisfied customers who have benefited from your health insurance coverage. Make them believe that your benefits and services will contribute to a holistic approach to better well-being.

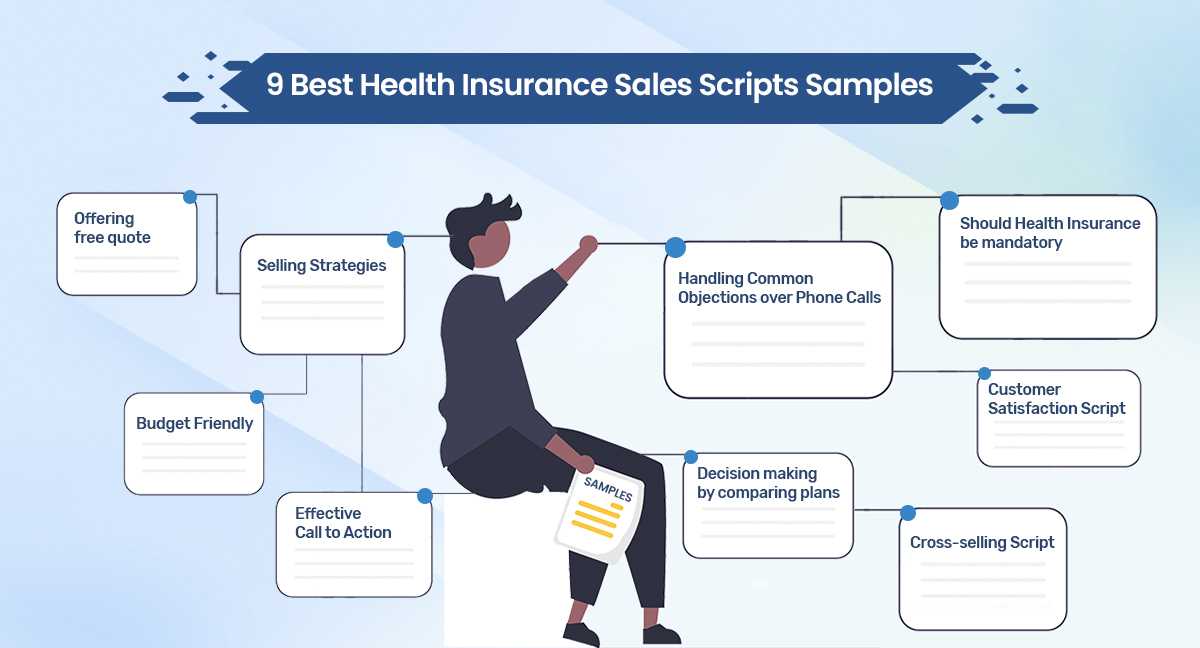

9 Best Health Insurance Sales Scripts Samples

Different health insurance sales scripts are being showcased with different scenarios. Have a look at it, explore these script samples, and choose wisely according to your client’s needs. Just make sure your scripts are well-crafted and must have a personalized approach.

1. Offering a free quote for your insurance

Agent:

I’m Yelenand. Today, I will assist you with a free quote for health insurance. How can I help you?

Customer:

I am Interested in knowing more about some options.

Agent:

Absolutely! Let me share a few options with you. Can You please share your age and any specific health issues?

Customer:

I am 37 years old, perfectly fit, and fine healthwise.

Agent:

Based on your age, we have some appropriate plans that offer comprehensive coverage. Plan B focuses on affordability, low-paying premiums, and lower deductible costs, which means you will gain more coverage. This could be perfect for you.

Customer:

Fine. Could you please provide me with more details?

Agent:

Good to go! I will prepare the quote and send it to you over email, and afterward, we’ll be in touch soon with the quote.

2. Cross-selling script to an existing customer

Agent:

Hello, We’re from VCX Insurance Company and wanted to discuss a golden opportunity that could enhance your coverage.

As you are our existing customer, it would be helpful for you.

Customer:

Yes, please! Share your offers.

Agent:

We recently introduced an add-on feature for health insurance plans called it “Health Core Plus” with additional advantages.

Customers will get access to better care service, membership with great discounts, and 24/7 telemedicine service. Would you like to get more details on it?

Customer:

Yes, please, let me brief you about its future benefits and how this will work.

Agent:

Sure! With this “Health Core Plus”, you will get access to annual check-ups, vaccinations, and screenings without any charge.

Additional advantages are gym membership discounts and many more to know. And it’s available at a nominal additional cost.

If you are interested, our team will add this to your existing premium plan. This would be a perfect fit for your small investment that could make a large difference in overall healthcare.

3. Try to make sell out or offer valuable health insurance

Agent:

Hello, I am from XYZ Insurance Company! I would like to assist you in finding the appropriate health insurance plan. As you know, it’s an investment for your well-being, accessing your financial protection with complete healthcare.

Customer:

Sounds interesting.

What type of health insurance do you offer i.e. plans?

Agent:

Our health insurance plans offer complete coverage such as doctor’s visit charges, medicines, after and before-services, and even doctor consultation charges, including emergency care and critical surgeries.

Customer:

That’s exactly what I was looking for! Like to know more about your offering and coverage network.

Agent:

Yes, please! Visit our website for detailed information or else our team will guide you through every plan with its benefits and limitations.

4. Handling Common Objections over Phone Calls

Customer:

Sorry, But I’m not sure about your health insurance coverage and am still confused about whether it’s worth the cost or not.

Agent:

I completely understand your concern. And don’t think about its worthiness because it’s an investment in yourself and your family’s health care well-being.

We provide you with fully accessible food that protects you from unexpected medical expenses that may arise due to current health scenarios.

Without health insurance, you will feel a burden at every stage of your life, but with our insurance coverage, you will free yourself from stress. Health insurance is a safety net, not a financial burden.

5. Highlighting Customer Satisfaction Script

Agent:

Our greatest pride is in our commitment to customer satisfaction. We give our 100% efforts to provide an effective experience, which is the best possible way for our policyholders by considering their needs and concerns.

Customer:

Sounds good! What exactly do you ensure about their satisfaction?

Agent:

Yes, our dedicated team works towards resolving their concerns or queries as soon as possible by providing appropriate solutions that may arise during their policy holding or after after-maturity.

Additionally, we work on getting regular feedback so that our team can review them and make changes in our services regularly. As our priority is customer satisfaction. For more valuable information, you can check out our health insurance website for testimonials from satisfied customers.

6. Offering affordable options

Customer:

Hello, I’m looking for health insurance, but my major concern is regarding its cost. Want to know if there are any affordable plans?

Agent:

Absolutely! We have all types of plans available that fit your budget.

By knowing your needs, preferences, and overall budget estimation, we can showcase your plans that are appropriate and best fit your needs ability.

As our insurance company’s goal is to offer healthcare without breaking the bank.

Customer:

What type of affordable options are included?

Agent:

Affordable plans might include coverage for doctor visits, medication charges, after-care services, etc.

Our company offers various cost-sharing arrangements, thereby keeping our premiums affordable. Thus, with our insurance plans, you will gain quality care while managing costs effectively.

7. Showcasing an Urgent need to Secure Health Insurance as soon as possible

Agent:

Hello sir/mam, I am calling from XYZ Insurance Company. I would like to help with your health insurance needs. How can I assist you today?

Customer: Yes, please go ahead.

Agent:

Health insurance is an important decision towards your healthy life.

I recommend you take insurance for yourself and your family and safeguard in case of unexpected medical expenses. Take action as soon as possible to have the coverage you need.

Customer:

Okay I’m getting it!

I just want to prepare my mind for any future medical expenses.

Agent:

Health is your wealth! Life is unpredictable, so it’s better to secure your life today.

I urge you to take an urgent step as unexpected circumstances may arise at any time. And if you are in good health, then why not get insurance that too at low premiums with high coverage options?

Customer:

Glad to know this! I will further contact you for final action.

8. Help them to make an informed decision by comparing plans

Agent:

I’d be delighted for you to make an informed decision regarding health insurance plans.

Based on our previous talks, you were slightly confused about which plan is best for you. Today, I will clear up all your doubts, and you will make the final decision.

Customer:

I would like to prefer insurance options that cover maternity coverage as I’m about to start my family planning.

So, my main concern is just that I need affordable plans along with maternity convergence.

Agent:

I understand your concern completely. We have multiple options, considering your needs and preferences.

We will send you 4-5 options as per your need and based on that, you can compare it and make an informed decision. Please provide us with your email address.

Customer:

Sure, and I will get back to you with the final one.

9. Call to action – a final enrollment process

Agent:

Hello! Thank you for considering our XYZ Insurance Company for your health insurance preferences.

I will guide you through the final steps so that you can enroll in an insurance plan further.

Customer:

Yes, please! I’ve made the final decision about which insurance plan I need to enroll in. Please guide me through the implementation process.

Agent:

Perfect! We’ll guide you through the entire process to ensure you a smooth enrollment experience. I needed details such as your full name, DOB, contact information, email address, etc. Please provide us.

Customer:

I will send you my details on your contact number with each photocopy.

Agent:

Yes received. Let’s further proceed with the enrollment process. Just confirm your final insurance plan number with me.

Customer:

Yes, my insurance plan number is (xxxxxxxxxx), and my policy name is (*********).

Agent:

Okay, done. You will get confirmation messages soon. Thank you for your cooperation.

Common Mistakes to Avoid while Cold Calling for Health Insurance

Many sales reps make mistakes while dealing with customers over call and this further leads to miscommunication or increases the level of drop calls. So, to avoid these common mistakes, you must be aware of them and make improvements for future conversations.

Insufficient preparation.

Many agents make the mistake of jumping into cold calling with insufficient preparation. Remember, before interacting with customers, make sure you research the prospect, their needs, and preferences, and make a clear understanding of your insurance plans before discussing and sharing information with them.

Centering product instead of the advantages.

Don’t bombard prospects’ minds with various plans of insurance, instead, try to showcase the benefits of leveraging healthcare coverage from your health insurance company. Try to concentrate on the value of your insurance offerings like their coverage features and reasonable premiums.

Choose a User-Friendly Interface.

Maximize a platform that is intuitive, scalable, and user-friendly. Look for a sales dialer and streamline your workflow as it offers compatibility with your existing systems and processes. These automated dialers will include smooth call logging, and call recording along with CRM integration tools and compliance monitoring.

Immesnsing prospect’s mind with too much information.

Make sure that you share your insurance-related information as short as possible. Keep it clear, and concise, and communicate to the point. It’s important to share only relevant information with the prospects like key benefits, additional info related to converge features, concerns, or queries that they may have.

Neglecting rapport building.

Keep in mind that while talking with prospects, agents must be able to build rapport as it’s an essential factor in any sales conversation. Work on connection building and be friendly and professional in terms of conversation. First try to understand their opinions, concerns or queries then present your point and thereby build rapport.

Avoid being pushy.

Keep calm during conversations with prospects. Try to degrade your aggressive nature while dealing with them as many times situations may arise that prospects are not interested in your product/services and not ready to proceed further then you should respect their decision. Remember, offer them a follow-up for next time at their convenience.

FAQ:

1. Is cold calling effective in insurance?

Cold calling is an effective way to boost health insurance sales. 70% of sellers connect with clients and generate meetings over the phone.

2. How can I improve my sales script for Health Insurance?

Develop a strong sales script with a powerful CRM system and thereby track your leads effectively and make improvements accordingly.

3. How do you pitch a health insurance sale?

First, try to understand your products/services’ weaknesses, strengths, and benefits. Afterward, have clear and concise communication with your potential customers by maintaining your confidence level and accurately pitching a health insurance plan to match an individual’s needs.

4. Is cold call illegal?

Cold calling is not illegal. However, there are certain laws and regulations that companies must follow to avoid any legal issues. These laws and regulations mainly safeguard the privacy of consumers and thus prevent unsolicited communications.

Conclusion

Remember, with cold calling optimization, you must be confident, empathetic, and well-prepared. Make sure you adapt these above sales script samples as a foundation for lead generation. It’s time to secure those sales and get out there and build relationships, and rapport and convert them into potential clients.