The insurance industry is quite complicated, and agencies have to invest in customer service to build customer loyalty and differentiate their offerings. Like many other businesses, insurance agencies use many solutions to enhance their efficiency and profitability. CRM software and call center solutions top the list of resources that offer a wide range of benefits to businesses in this niche.

CRM, i.e., Customer Relationship Management platforms, are the perfect place to store information about your clients. This is where you can organize your claims and leads, automate assignments to suitable agents and manage multiple policies in a centralized manner.

Now add call center software to the mix. Insurance companies use it to call their leads and prospects and handle any incoming inquiry calls.

Integrating the two provides a powerful solution to the insurance company for the ultimate customer experience success. And that’s not the only advantage.

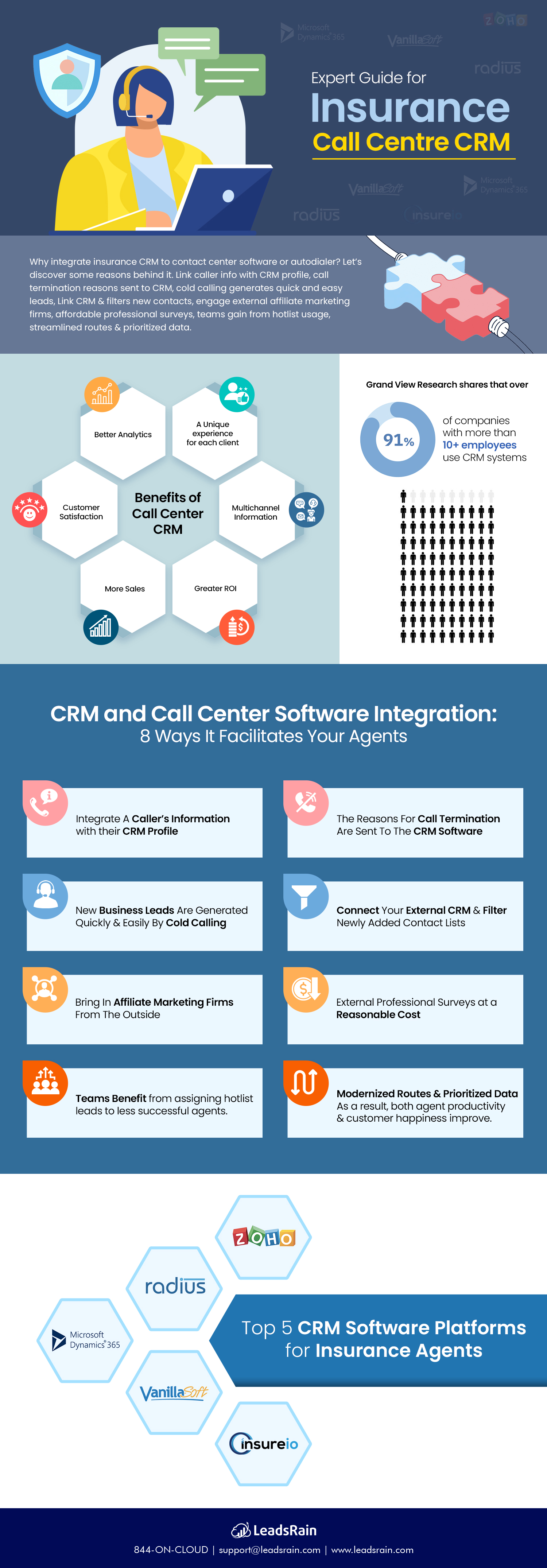

Benefits of Integrating CRM With Call Center Software

A large number of insurance agencies have their own call centers. This is primarily due to the affordability of auto dialer solutions and related cloud-based solutions.

But better outreach practices require an in-depth look at customer needs while also maximizing contact time and connections. That’s why CRMs work very well with dialers and call center solutions.

CRM data can be integrated with call center software, assigning calls to an agent with the most relevant experience. It can also connect callers to the best possible service rep to address their concerns.

Such integration gives the representative pertinent consumer information so they can respond to queries more holistically. Otherwise, it would be difficult for them to keep track of all the client information collected. Moreover, these specifics may be misplaced or forgotten in databases and files, but CRM can present them to the user on a unified interface.

Thus, the key motivations for this integration include the following:

- Better analytics

- A Unique experience for each client

- Availability of client information across many channels

And these ultimately lead to:

- Increased customer satisfaction

- More sales

- Greater ROI

CRM and Call Center Software Integration: 8 Ways It Facilitates Your Agents

Here are a few reasons why you should integrate insurance CRM to contact center software or auto dialer

1. Integrate A Caller’s Information with Their CRM Profile

Whenever a call comes in, the number is looked up in the customer relationship management system to see if it matches an existing contact. If the contact has been located, the agent can see their information, orders, and actions via a streamlined dialer interface. Any changes made are immediately reflected in the customer relationship management system. It speeds up the contact handling process and reduces the need for human data entering.

2. The Reasons For Call Termination Are Sent To The CRM Software

A new record is generated in the CRM whenever an agent chooses a reason to end a call. Multiple fields are matched, and context-relevant data is synchronized on its own. Powerful dialer capabilities, such as predictive dialing, allow agents to dramatically enhance hit rates while remaining completely open and honest with customers.

3. New Business Leads Are Generated Quickly And Easily By Cold Calling

Any time an agent schedules a meeting, the contact’s details are saved in a CRM Lead. Additionally, information on the meeting is added as an Event in the CRM software. Working with third-party bookers is streamlined with the help of an auto-dialer for your CRM.

4. Connect Your External CRM And Filter Newly Added Contact Lists

Existing CRM contacts, leads, and accounts are removed before a new paid lead list is imported into the auto-dialer. This results in significant savings for outsourced call centers, decreasing the cost per lead by preventing duplication of effort.

5. Bring In Affiliate Marketing Firms From The Outside

Each lead added to a CRM contact list by an affiliate marketing organization is verified with blacklists and existing contact lists before approval. Integrating the auto-dialer with the CRM helps to cut down on unnecessary steps in the sales process and save time.

6. Professional Surveys At A Reasonable Cost

An external survey firm can be given survey codes based on the reason a call was terminated and the status of an order. Whether or not a customer has placed a purchase triggers a different set of automatic questionnaires. This allows for far cheaper surveys overall.

7. Teams Benefit From The Use of Hotlists

Auto-dialer and CRM data are integrated to provide rich context about contacts, calls, and settings for hotlist management. Contacts from the hot list are distributed mechanically to agents depending on their efficiency, history of working with the client, and other factors. The team as a whole can be more productive and see a significant increase in hit rates by assigning hotlist leads to less successful agents.

8. Modernized Routes And Prioritized Data

Contacts are matched in the CRM and directed to the appropriate departments or individuals based on predetermined criteria. Depending on their expertise, location, and language, different leads or customers can be prioritized and redirected to the most qualified agents. As a result, both agent productivity and customer happiness improve.

Top 5 CRM Software Platforms for Insurance Agents

Several alternatives exist when picking an insurance company’s customer relationship management system.

1. Zoho CRM

More than 150,000 companies have adopted it across the globe. It facilitates the orderly management of leads, the administration of different policies, and the automation of sales processes. The engineers at Zoho offer to tailor their product to the insurance firm’s unique requirements if that will improve productivity and quality of life.

Agents utilize it to stay in touch with their insureds, find new businesses, and streamline their processes through automation. Using Zoho CRM, you can reach policyholders by email, live chat, phone, and even social media platforms.

2. RadiusBob

RadiusBob, a customer relationship management system tailored to the insurance business, enjoys widespread popularity amongst insurance brokers. They provide insurance agents with lead management and customer relationship management tools.

Agents and major corporations use it to consolidate their interactions with policyholders. The call center phone services are just one more feature of this highly adaptable lead management and sales software.

The CRM’s abbreviated moniker, “Book of Business” (or “bob”), refers to the company’s client roster.

3. Microsoft Dynamics 365

A CRM system from the largest software company in the world provides a configurable, unified workstation for insurance companies of all sizes.

It enables the implementation of multichannel marketing campaigns, the tracking of complete customer data to assess and make better business-growth decisions, and the automation of sales procedures.

Dynamics 365 allows utilizing CRM as a standalone solution or connecting it with other operational tools to develop a robust, unified system for all business requirements.

4. VanillaSoft

The inside sales representative can use the tools and resources from VanillaSoft’s sales engagement platform. Some of the services it offers are prerecorded voicemails, customizable call scripts, and the ability to monitor customer interactions in real time.

All insurance agents, whether they have experience or not, can benefit from their products and services.

5. Insure.io

Both independent insurance agents and large firms can use Insure.io. An automated and systematic method of approaching sales, lead creation and management, and customer support is emphasized, allowing you to utilize your time better.

The product’s users might expect more sales and decreased paperwork. It’s the best customer relationship management software for life insurance agents.

In addition, all of the packages incorporate phone, text, and social networking features.

Conclusion

A customer relationship management system tailored to the insurance industry is critical to any agency looking to compete successfully. It can take care of everything, from customer management to automated workflows.

With powerful call center software, it can answer all your customer and lead-related issues while providing in-depth data on your new and old customers.

These insurance CRM solutions above represent cutting-edge automated platforms packed with valuable features, perfect for fostering meaningful connections between businesses and their customers.

Find the customer relationship management system that works best for you and use it in tandem with our Call Centre Software to maximize the results. Still not convinced? Talk to our experts now or write us back at support@leadsrain.com